UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as Permitted Byby Rule 14A-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-12

CLOVER HEALTH INVESTMENTS, CORP.

(Name of Registrant as Specified In Itsin its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

CLOVER HEALTH INVESTMENTS, CORP.

3401 Mallory Lane

Suite 210

Franklin, TN 37067

(201) 432-2133

August 12, 2022April 26, 2024

Dear Stockholder:

The 20222024 annual meeting of stockholders (the "Annual Meeting") of stockholders of Clover Health Investments, Corp. (the "Company") will be held on September 22, 2022June 10, 2024, at 11:3000 a.m. Eastern Time. The Annual Meeting will be a virtual meeting. YouStockholders will be able to attend the virtual-only Annual Meeting, virtually and vote and submit questions by visiting www.virtualshareholdermeeting.com/CLOV2022.CLOV2024. Stockholders may vote and submit questions in advance of the meeting by visiting www.proxyvote.com. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying proxy statement ("Proxy Statement"). Any reference hereinin this Proxy Statement to attending the Annual Meeting, including any reference to "in person" attendance, means attending by remote communication via live webcast on the Internet.

The formal notice of the Annual Meeting and the Proxy Statement appear on the following pages. We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission's "notice and access" rules. After reading the Proxy Statement, please submit your proxy via the Internet, by telephone or by requesting a printed copy of the proxy materials and using the enclosed proxy card. You may vote via the Internet or by telephone up to the time the polls close at the meeting.Annual Meeting. Please review the instructions on each of your voting options described in the accompanying Proxy Statement, as well as the Notice of Internet Availability of Proxy Materials you received.

Whether or not you plan to attend the Annual Meeting, please read the Proxy Statement and vote your shares.

On behalf of the Board of Directors, we thank you for your continued support and look forward to seeing you virtually at the Annual Meeting.

Sincerely,

Vivek GaripalliAndrew Toy

Co-Founder, Chief Executive Officer and Chairman of the BoardDirector

Clover Health Investments, Corp.

CLOVER HEALTH INVESTMENTS, CORP.

3401 Mallory Lane

Suite 210

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

September 22, 2022June 10, 2024

11:3000 A.M. Eastern Time

We invite you to attend the 20222024 annual meeting of stockholders (the "Annual Meeting") of Clover Health Investments, Corp., a Delaware corporation ("Clover Health," the "Company," "our company," "we," "our" or "us"), to consider and vote upon:

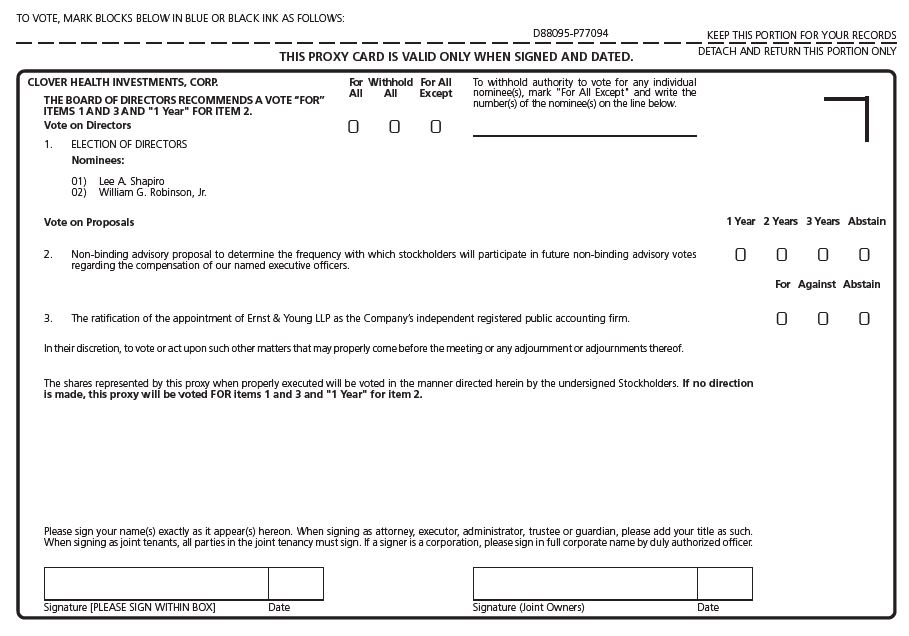

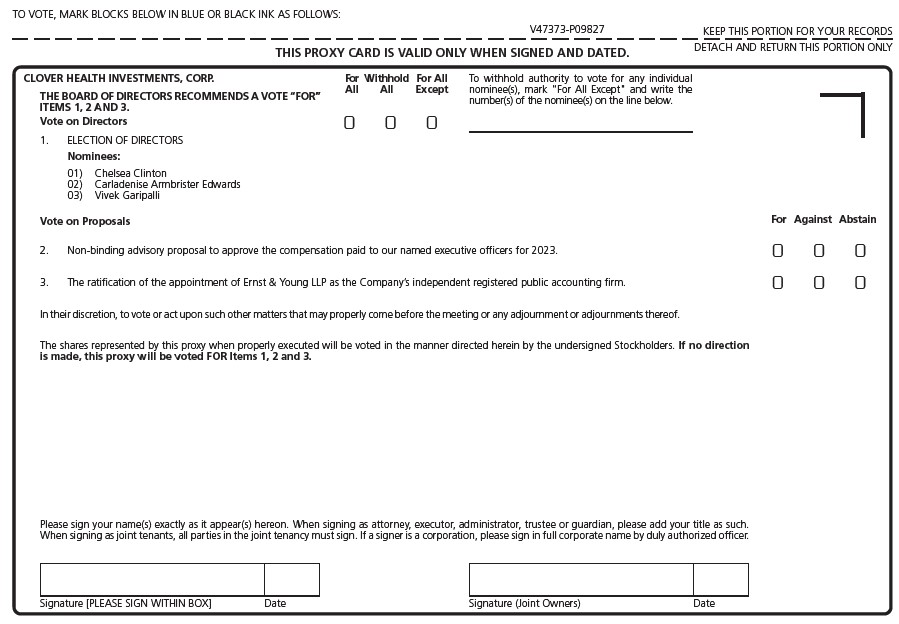

1.The election of Lee A. ShapiroChelsea Clinton, Carladenise Armbrister Edwards and William Robinson, Jr.Vivek Garipalli as Class IIII directors, to serve until the 20252027 annual meeting of stockholders and until their successors are duly elected and qualified;

2.A non-binding advisory proposal to determine the frequency with which stockholders will participate in future non-binding advisory votes to approve the compensation ofpaid to our named executive officers;officers ("NEOs") for 2023 as disclosed in the attached Proxy Statement (a "Say on Pay" vote);

3.The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022;2024; and

4.Any other business that may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting.

The BoardOur board of directors (the "Board") recommends that you vote (i) "FOR" the election of each of the nominees to the Board, (ii) "FOR" the approval of the compensation paid to our NEOs for the option of every 1 year on the non-binding advisory proposal on the frequency of holding future non-binding votes to approve executive compensation2023 and (iii) "FOR" the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

The record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on August 2, 2022.April 15, 2024. Only stockholders of record at that date are entitled to notice of, and to vote at, the meeting.Annual Meeting. For more information, please read the accompanying Proxy Statement.

The Annual Meeting will be held in a virtual meeting format only. You will be able to attend the virtual-only Annual Meeting, by remote communication and vote and submitask questions during the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/CLOV2022.CLOV2024. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying Proxy Statement. You may vote and submit questions in advance of the meeting by visiting www.proxyvote.com. Any reference hereinin the Proxy Statement to attending the Annual Meeting, including any reference to "in person" attendance, means attending by remote communication via live webcast on the Internet.

It is important that your shares are represented at the Annual Meeting. Stockholders of record as of the close of business on the record date may vote their shares online at the virtual Annual Meeting, or authorize a proxy (1) via the Internet, (2) by telephone or (3) (ifif you have received paper copies of our proxy materials)materials, by submitting your enclosed proxy card.

Sincerely,

Joseph MartinKaren Soares

General Counsel and Corporate Secretary

August 12, 2022April 26, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 20222024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 22, 2022.JUNE 10, 2024.

This Notice of our Annual Meeting, the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021,2023, are available by visiting www.virtualshareholdermeeting.com/CLOV2022.CLOV2024.

TABLE OF CONTENTS

GENERAL INFORMATION

What is included in these proxy materials? What is a proxy statementProxy Statement and what is a proxy?

The proxy materials for the 20222024 annual meeting of stockholders (the "Annual Meeting") of Clover Health Investments, Corp., a Delaware corporation ("Clover," "Clover Health," the "Company," "our company," "we," "our," or "us"), include the Notice of Annual Meeting, this Proxy Statement ("Proxy Statement"), our 20212023 Annual Report on Form 10-K ("Annual Report" or "10-K""Form 10-K") and a proxy card or voting instruction form. The Company has made these proxy materials available to you by Internet or, upon your request, has deliveredwill deliver printed versions of these materials to you by mail, because you were a stockholder of record at the close of business on August 2, 2022.April 15, 2024.

Our principal executive offices are located at 3401 Mallory Lane, Suite 210, Franklin, TNTennessee 37067.

A "proxy statement" is a document that U.S. Securities and Exchange Commission ("SEC") regulations require us to give you when we ask you to sign a proxy designating individuals to vote on your behalf. The word "proxy" has two meanings. A "proxy" is the legal designation of another person to cast the votes entitled to be cast by the holder of the shares and is sometimes called a "proxy card." That other designated person is called a "proxy" and is sometimes referred to as a "proxy holder."

We have designated two of our officers as proxies for the Annual Meeting. When you authorize a proxy via the Internet, by telephone or, (ifif you have received paper copies of our proxy materials)materials, by returning a proxy card, you appoint Vivek GaripalliAndrew Toy and Joseph MartinKaren Soares as your proxyproxies at the Annual Meeting (the "proxy"), with full power of substitution by anyeach of them. Even if you plan to attend the Annual Meeting, we encourage you to authorize a proxy to vote your shares in advance via the Internet, by telephone or, (ifif you have received paper copies of our proxy materials)materials, by returning a proxy card. If you authorize a proxy via the Internet or by telephone, you do not need to return your proxy card.

The form of proxy and this Proxy Statement have been approved by our board of directors (the "Board" or "Board of Directors") and are being provided to stockholders by itsthe Board's authority. These materials were first made available or sent to you on August 12, 2022.April 26, 2024. Any reference in this Proxy Statement to attending the Annual Meeting, including any reference to "in person" attendance, means attending by remote communication via live webcast on the Internet.

Why did I receive a one-page notice in the mail regarding the Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with rules adopted by the SEC, the Company uses the Internet as the primary means of furnishing proxy materials to our stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the "Notice") to ourall of stockholders. All stockholders will be able to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or how to request a printed copy may be found in the Notice, proxy card or voting instruction form. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet in order to help reduce the environmental impact of itsthe Annual Meetings and reduce the cost to the Company of physically printing and mailing materials.

What am I voting on at the Annual Meeting?

At the Annual Meeting, our stockholders are asked to consider and vote upon:

•the election of Lee A. ShapiroChelsea Clinton, Carladenise Armbrister Edwards and William G. Robinson, Jr.Vivek Garipalli as Class IIII directors, to serve until the 20252027 annual meeting of stockholders and until their successors are duly elected and qualified;

•a non-binding advisory proposal to determine the frequency with which stockholders will participate in future non-binding advisory votes regardingapprove the compensation of our named executive officers;officers ("NEOs") for 2023;

•the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022;2024; and

•any other business that may properly come before the Annual Meeting or any postponement or adjournment thereof.of the Annual Meeting.

How does the Board recommend I vote?

The Board recommends that you vote as follows:

•FOR the election of each of the Board's nominees for Class IIII directors;

•for the option of every 1 year onFOR the non-binding advisory proposal determining the frequency with which stockholders will participate in future non-binding advisory votes regardingapproving the compensation of our named executive officers;NEOs for 2023; and

•FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024.

What does it mean to vote by proxy?

It means that you give someone else the right to vote your shares in accordance with your instructions. In this way, you ensure that your vote will be counted even if you are unable to attend the Annual Meeting. If you properly sign and deliver your proxy but do not include specific instructions on how to vote, the individuals named as proxies will vote your shares as follows:

•FOR the election of each of the Board's nominees for Class IIII directors;

•for the option of every 1 year onFOR the non-binding advisory proposal on the determining the frequency with which stockholders will participate in future non-binding advisory votes regardingapproving the compensation of our named executive officers;NEOs for 2023; and

•FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024.

The individuals named as proxies will vote in their discretion on any other matter that may properly come before the Annual Meeting or any postponement or adjournment thereof.of the Annual Meeting.

Who is entitled to vote?

Only holders of our Class A common sharesstock ("Class A Shares"common stock") and Class B common sharesstock ("Class B Shares"common stock" and, together with our Class A common stock, the "common stock") at the close of business on August 2, 2022April 15, 2024 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting. The holders of eachthe shares of our Class A Share outstandingcommon stock are entitled to one vote per share. The holders of eachthe shares of our Class B Share outstandingcommon stock are entitled to ten votes per share. The holders of our Class A Sharescommon stock and our Class B Sharecommon stock generally vote together as a single class on all matters (including the election of directors) submitted to a vote of our stockholders, unless otherwise required by Delaware law or the charter.our amended and restated certificate of incorporation. There were 383,247,718406,150,260 shares of our Class A Sharescommon stock and 94,395,16889,649,365 shares of our Class B Sharescommon stock outstanding on August 2, 2022.April 15, 2024.

How do I attend and submit my votes for the Annual Meeting?

You should submit your proxy card or voting instruction form as soon as possible. If you received or requested printed copies of the proxy materials by mail, the materials will include a proxy card for registered stockholders (if you hold your shares of common stock directly in your name through our transfer agent, Continental Stock Transfer & Trust Company), or a voting instruction form for beneficial owners (if your shares of common stock are held in "street name," such as in a stock brokerage account or through a bank or other nominee). Whether you are a registered stockholder or hold any of your shares in "street name," you may vote in the following ways:

Prior to the Virtual Meeting. We encourage you to vote your shares in advance of the Annual Meeting by one of the methods described below, even if you plan to attend the Annual Meeting. You will be able to vote prior to the Annual Meeting by visiting www.proxyvote.com and following the online instructions. If you have already voted prior to the Annual Meeting, you may nevertheless change or revoke your vote at the Annual Meeting as described below. Each stockholder may appoint only one proxyholder or representative to attend on the stockholder's behalf. Internet and telephone voting will close at 11:59 p.m. Eastern Time on June 9, 2024 (the day before the Annual Meeting).

At the Virtual Meeting. You will be able to attend the Annual Meeting virtually and vote and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/CLOV2022CLOV2024 and following the online instructions. If you own common stock of record, you may attend the Annual Meeting and vote, regardless of whether you have previously voted via the Internet, by telephone or by returning a proxy card. Stockholders who attend the Annual Meeting by following the above instructions will have an opportunity to vote and to submit questions electronically in accordance with the rules of conduct for the meeting. Only stockholders as of the Record Date are entitled to attend the Annual Meeting.

Prior to the Virtual Meeting. We encourage you to vote your shares in advance of the Annual Meeting by one of the methods described herein, even if you plan to attend the Annual Meeting. You will be able to vote prior to the Annual Meeting by visiting www.poxyvote.com and following the online instructions. If you have

already voted prior to the Annual Meeting, you may nevertheless change or revoke your vote at the Annual Meeting as described below. Each stockholder may appoint only one proxyholder or representative to attend on the stockholder's behalf. Internet and telephone voting will close at 11:59 p.m. Eastern Time on the day before the Annual Meeting.

| | | | | | | | |

VOTE BY INTERNET Shares Held of Record:

Prior to

To vote before the meeting, visit www.proxyvote.com Voting on www.proxyvote.com will close at 11:59 p.m. Eastern Time on the day before the Annual Meeting: www.proxyvote.comMeeting During the Annual Meeting: www.virtualshareholdermeeting.com/CLOV2022

| | VOTE BY TELEPHONE Shares Held of Record:

1-800-690-6903

|

Shares Held in Street Name: | | Shares Held in Street Name: |

Prior toTo vote before the meeting, dial toll-free 1-800-690-6903.Voting by phone will close at 11:59 p.m. Eastern Time on the day before the Annual Meeting: www.proxyvote.com

During the Annual Meeting: www.virtualshareholdermeeting.com/CLOV2022

24 hours a day / 7 days a week

| | See Voting Instruction Form

24 hours a day / 7 days a week

Meeting

|

INSTRUCTIONS:

To vote at the meeting, visit www.virtualshareholdermeeting.com/CLOV2024

| | INSTRUCTIONS:

• Read this Proxy Statement.

• Go to the website listed above.

• Have your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form in hand and follow the instructions.

| | • Read this Proxy Statement.

• Call the applicable number noted above.

• Have your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form in hand and follow the instructions.

|

To vote by mail, follow the instructions set forth on your proxy card or voting instruction form.

How do I submit questions for the Voting Instruction Form.Annual Meeting?

You will be able to submit questions prior to the Annual Meeting by visiting www.proxyvote.com and following the online instructions. Questions submitted prior to the Annual Meeting must be submitted no later than 11:59 p.m. Eastern Time on June 9, 2024 (the day before the Annual Meeting). You will be able to submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/CLOV2024. We will respond to questions as time permits, provided that they are relevant and applicable to our business.

Who will count the vote?

A representative of Broadridge Financial Solutions, an independent tabulator, will count the vote and act as the inspector of election.

How do I revoke or change a vote?

If you own common stock of record, you may revoke your proxy or change your voting instructions at any time before your shares are voted at the Annual Meeting by delivering to the Corporate Secretary of the Company a written notice of revocation or a duly executed proxy via the Internet, by telephone or by returning a proxy card bearing a later date or by attending the Annual Meeting and voting. A stockholder owning common stock in street name may revoke or change voting instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institution and voting at the Annual Meeting.

What does it mean if I receive more than one Notice, proxy or voting instruction form?

It means your shares are registered in more than one account. Please complete and provide your voting instructions for all Notices, proxy cards and voting instruction cardsforms that you receive. We encourage you to register all your accounts in the same name and address. Registered stockholders may contact our transfer agent, Continental Stock Transfer & Trust Company. Street-nameStreet name stockholders holding shares through a bank, broker or other nominee should contact their bank, broker or nominee and request consolidation of their accounts.

What constitutes a quorum?

The holders of a majority of the voting power of the shares of our common stock issued and outstanding sharesand entitled to vote, in person or represented by proxy at the Annual Meeting, constitute a quorum. Holders of Class A common stock are entitled to one vote per share held. Holders of Class B common stock are entitled to ten votes per share held. A quorum is necessary to transact business at the Annual Meeting.

What is the effect of abstentions and broker non-votes?

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. A broker non-vote occurs when a bank, broker or other nominee holding shares for a beneficial owner submits a proxy for the Annual Meeting without voting on a particular proposal, because the bank, broker or other nominee has not received instructions from the beneficial owner and does not have discretionary voting power with respect to that proposal. A bank, broker or other nominee may exercise its discretionary voting power with respect to the ratification of the appointment of Ernst & Young LLP as our independent registered certified public accounting firm for fiscal year 20222024 (Item 3), but it does not have discretion to vote with respect to the election of directors (Item 1), or the nonbindingnon-binding advisory proposal on the frequency of holding future votes regardingapproving executive compensation for 2023 (Item 2).

What is the required vote to elect directors?

Item 1:A nominee for director shall be elected to the Board by a plurality of the votes cast in respect of the shares of common stock present or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. A plurality vote requirement means that the director nominees with the greatest number of votes cast, even if less than a majority, will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of directors. Cumulative voting is not permitted.

What is the required vote to approve each of the other proposals?

Item 2: We will considerApproval, on a non-binding advisory basis, of the frequencycompensation paid to our NEOs in 2023 requires the affirmative vote of holding future votes regarding executive compensation selected bya majority of the highest numbervoting power of votesthe outstanding shares of our Class A common stock and our Class B common stock cast (every one, two or three years)in person or represented by proxy at the Annual Meetingto be and voted for or against the recommendation of our stockholders with respect to the non-binding advisory proposal. Abstentions and broker non-votes will have no effect on the outcome ofnon-binding advisory proposal. Broker non-votes have no effect on the non-binding advisory proposal.

Item 3: 3: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of a majority of votesthe voting power of the outstanding shares of our Class A common stock and our Class B common stock, cast in person or represented by proxy at the Annual Meeting.Meeting and voted for or against the proposal. Abstentions will count as a vote "against"have no effect on the ratification of the appointment of Ernst & Young LLP.

Why are you holding a virtual Annual Meeting?

The Annual Meeting will be held by remote communication in a virtual meeting format only. We believe that the virtual meeting format will provide expanded access, improved communication and cost savings for our stockholders and the Company.

The Annual Meeting will convene at 11:3000 a.m. Eastern Time on September 22, 2022.June 10, 2024. We encourage you to access the Annual Meeting prior to the start time leavingto allow ample time for the check-in process.

How are proxies solicited and what iswho bears the cost?

The accompanying proxy is solicited by and on behalf of the Board, and the cost of such solicitation will be borne by the Company. Solicitations may be made by mail, personal interview, telephone, and electronic communications by directors, officers, and other Company employees without additional compensation. Broadridge Financial Solutions Inc. will distribute proxy materials to banks, brokers, and other nominees for forwarding to beneficial owners and will request brokerage houses and other custodians, nominees, and fiduciaries to forward soliciting material to the beneficial owners of the common stock held on the record dateRecord Date by suchthose persons. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their expenses in forwarding solicitation materials.

What is "householding"?

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice of Proxy Materials or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family, unless we have received contrary instructions from one or more of the stockholders. This practice, referred to as "householding," benefits both you and us.the Company. It reduces the volume of duplicate information received

at your household and helps to reduce our expenses. The rule applies to our Notices, of Proxy Materials, annual reports, proxy statements and information statements.

We will undertake to deliver promptly, upon written or oral request, a separate copy to a stockholder at a shared address to which a single copy of the Notice of Proxy Materials or proxy materials was delivered. You may make a written request by sending a notification to: Corporate Secretary, Clover Health Investments, Corp., 3401 Mallory Lane, Suite 210, Franklin, TN 37067, providing your name, your shared address, and the address to which we should direct the additional copy of the Notice of Proxy Materials or proxy materials. Multiple stockholders sharing an address who have received one copy of a mailing and would prefer us to mail each stockholder a separate copy of future mailings should contact us at our principal executive offices.the Corporate Secretary as the address above. Additionally, if current stockholders with a shared address received multiple copies of a mailing and would prefer us to mail one copy of future mailings to stockholders at the shared address, notification of that request may also be made through our principal executive offices.Corporate Secretary. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Board of Directors

The following table provides information regarding our directors as of August 2, 2022:April 26, 2024:

| | | | | | | | | | | | | | |

| Name | | Age | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Position(s) |

| | | | | | | | | | | | | | Directors |

NameAndrew Toy | | 45 | | Age | Position(s) | |

Directors | Co-Founder, Chief Executive Officer and Director |

| Vivek Garipalli | | 45 | | 44 | ChiefCo-Founder and Executive Officer and Chairman | |

Andrew Toy | | 43 | | President and Director | Chairperson |

Chelsea Clinton(1)(2) | | 44 | | 42 | Director | |

Carladenise Armbrister Edwards(1)(2)(4) | | 54 | | 52 | Director | |

Demetrios L. Kouzoukas(3)(4) | | 48 | | 46 | Lead Independent Director | |

Anna U. Loengard(1)(4) | | 55 | | Director |

William G. Robinson, Jr.(1)(3) | | 59 | | 57 | Director | |

Lee A. Shapiro(2)(3) | | 68 | | 66 | Director | |

(1) Member of the Talent and Compensation Committee.

(2) Member of the Nominating and Corporate Governance Committee.

(3) Member of the Audit Committee.

(4) Member of the Clinical Committee.

The following Class IIII directors are nominated for election at the Annual Meeting to serve until the 20252027 annual meeting of stockholders and until their successors are duly elected and qualified:

Chelsea Clinton. Chelsea Clinton has served as a member of our Board of Directors since February 2017. Since March 2013, Ms. Clinton has served as Vice Chair of the Clinton Foundation, where her work emphasizes improving global and domestic health, creating service opportunities and empowering the next generation of leaders. Ms. Clinton has also served as an Adjunct Assistant Professor at Columbia University's Mailman School of Public Health since 2012. Ms. Clinton has served as a member of the board of directors of the Clinton Health Access Initiative since September 2011. Ms. Clinton has served as a member of the boards of directors of IAC Holdings, Inc., a media and internet company, since September 2011, and Expedia Group, Inc. (formerly Expedia, Inc.), an online travel shopping company, since March 2017. In addition to her for-profit affiliations, Ms. Clinton currently serves on the boards of directors of the School of American Ballet, the Africa Center, the Weill Cornell Medical College and Columbia University's Mailman School of Public Health, and as Co-Chair of the Advisory Board of the Of Many Institute at New York University. Ms. Clinton holds a B.A. in history from Stanford University, an MPhil and a DPhil in international relations from Oxford University and an M.P.H. from Columbia University's Mailman School of Public Health. We believe that Ms. Clinton is qualified to serve as a member of our Board of Directors because of her extensive health background, her experience as a director of public companies and non-profit organizations and her knowledge of our industry.

Carladenise Armbrister Edwards. Carladenise Armbrister Edwards has served as a member of our Board of Directors since July 2022. Since August 2023, Dr. Edwards has served as Miami-Dade County's Chief Administrative Officer. From July 2020 to August 2022, Dr. Edwards served as the Executive Vice President and Chief Strategy Officer of the Henry Ford Health System, where she led the system's strategic planning efforts and partnership ventures, business development and transformation initiatives, government affairs strategy, as well as Henry Ford Innovations. Prior to Henry Ford, Dr. Edwards was Executive Vice President and Chief Strategy Officer for Providence St. Joseph Health, a health system, from July 2018 to June 2020, and the Senior Vice President, Contracting for Providence St. Joseph Health from January 2017 to July 2018. Dr. Edwards' experience includes several additional executive leadership roles, including Chief Administrative Officer for Providence Health & Services' Population Health division and Chief Strategy Officer for Alameda Health System. Dr. Edwards also served as Founding President and Chief Executive Officer of Cal eConnect, Inc., a nonprofit corporation that governed California's electronic Health Information Exchange. Additionally, she served as Chief of Staff and Interim Commissioner for Georgia's Department of Community Health. Dr. Edwards holds a Ph.D. in Medical Sociology from the University of Florida, a master's degree in education and psychological services and a bachelor's degree in sociology from the University of Pennsylvania. We believe that Dr. Edwards is qualified to serve as a member of our Board of Directors due to her expertise in the intersection of healthcare and technology, and her leadership experience in the healthcare industry.

Vivek Garipalli.Vivek Garipalli co-founded Clover Health in 2014 and served as our Chief Executive Officer from July 2014 to December 2022. He has been a member of our Board of Directors since July 2014 and was appointed Executive Chairperson of the Board effective as of January 1, 2023. Mr. Garipalli also served as our President from July 2014 to March 2019. Prior to Clover Health, Mr. Garipalli co-founded both CarePoint Health and Ensemble Health. He served as Co-Founder and Board Member from 2008 to 2022 at CarePoint, a healthcare system that offers acute care and emergency services to a large, historically underserved population. He served as Co-Founder and Board Member from 2014 to 2016 at Ensemble Health, a national healthcare revenue cycle services company. At Flatiron Health, Mr. Garipalli entered as an early investor and advised on its strategy and business model, including leading the acquisition of its data platform, Altos. He subsequently served on Flatiron Health’s board from 2012 through its sale to Roche in 2018. He has also previously served or is currently serving on the boards of Cityblock Health, Doctor Evidence, Medically Home, Thyme Care and Swiftly Systems Inc. Mr. Garipalli began his career in finance, holding roles at Credit Suisse First Boston, J.P. Morgan Partners and Blackstone Group. Wormhole Capital, the investment arm of Mr. Garipalli's family office, partners with special founders with the aptitude to build transformative, category-defining companies. Mr. Garipalli holds a B.B.A. in entrepreneurship from Emory University. We believe that Mr. Garipalli is qualified to serve as a member of our Board of Directors due to the perspective and experience he brings as Clover Health's co-founder and former Chief Executive Officer and due to his extensive experience managing and advising healthcare companies.

The following Class I directors' terms will continue until the 2025 annual meeting of stockholders:

Anna U. Loengard. Anna U. Loengard has served on our Board of Directors since November 2022. From August 2020 to October 2022. she served as the Chief Medical Officer of AccentCare, an enterprise providing home health, hospice and private care services. Previously, Dr. Loengard served as the Chief Medical Officer for Caravan Health from July 2017 to June 2020; the Chief Medical Officer for the Queen’s Healthcare System’s Clinically Integrated Physician Network from October 2014 to June 2017, and the Chief Medical Officer at St. Francis Healthcare System from February 2011 to February 2014, focusing on post-acute care. She received her M.D. from the State University of New York at Stony Brook and completed her residency in Internal Medicine at Harvard Medical School, Beth Israel Deaconess Medical Center, and her Geriatrics Fellowship at the University of Arizona. We believe that Dr. Loengard is qualified to serve as a member of our Board of Directors because she is a highly accomplished physician executive with significant experience in both geriatric medicine and value-based care models.

William G. Robinson, Jr. Jr.William G. Robinson, Jr. has served as a member of our Board of Directors since March 2021. Mr. Robinson has served as the President of Broadgate Human Capital, LLC, a management consulting firm, since October 2018. Prior to Broadgate, Mr. Robinson served as the Executive Vice President and Chief Human Resources Officer for Sabre Corporation, a travel technology company, from December 2013 to September 2017. Prior to Sabre, Mr. Robinson served as the Senior Vice President and Chief Human Resources Officer at Coventry Health Care, a diversified managed health care company, from 2012 to 2013. From 2010 to 2011, Mr. Robinson served as Senior Vice President forof human resources at Outcomes Health Information Solutions, a healthcare analytics and information company specializing in the optimization and acquisition of medical records. Prior to that, from 1990 to 2010, he worked for General Electric, where he held several human resources leadership roles in diverse industries, including information technology, healthcare, energy, security and industrial. Mr. Robinson has served as a member of the board of directors of American Public Education, Inc. since June 2016 and as a member of the board of trustees for the American Public University System since May 2020. Mr. Robinson holds a B.A. in communications from Wake Forest University and an M.A. in human resources from Bowie State University. We believe that Mr. Robinson is qualified to serve as a member of our Board of Directors because of his extensive experience as an executive officer in technology and healthcare companies, his experience as a director of a public company, and his knowledge of our industry.

Lee A. Shapiro. Lee A. Shapiro has served as a member of our Board of Directors since January 2021. Mr. Shapiro co-founded and has served as the Managing Partner at 7Wire Ventures, an early-stage healthcare venture fund, since June 2013. Mr. Shapiro previously served as Chief Financial Officer of Livongo Health, Inc., a mobile health monitoring technology company, from December 2018 to November 2020, and as a member of its board of directors from August 2013 until April 2019. Mr. Shapiro joined Allscripts Healthcare Solutions, Inc., a provider of electronic prescribing, practice management and electronic health record technology, in April 2000 and served as President from April 2002 to December 2012. He previously served as a director of Tivity Health, Inc., a provider of fitness and health improvement programs, from May 2015 to May 2020, and as a director of Medidata Solutions, Inc., a global provider of cloud-based solutions for life sciences, from June 2011 to October 2019. He has also served as a director of Click Therapeutics, Inc., a biotechnology company, since April 2021, and as a director of Senior Connect Health Acquisition Corp. I, a special purpose acquisition company, sincefrom 2020 to 2023, and he serves as a director of some of the 7Wire Ventures portfolio companies. He serves on the National Board of, and as Treasureris Chairperson elect of, the American Heart Association and the advisory board of the University of Chicago George Schulz Innovation Fund. Mr. Shapiro holds a B.S. in accountancy from the University of Illinois Urbana-Champaign and a J.D. from Thethe University of Chicago Law

School. We believe that Mr. Shapiro is qualified to serve as a member of our Board of Directors because of his extensive finance background, including service as a Chief Financial Officer of a public company, his experience as a director of a public company, and his knowledge of our industry.

The following Class II directors'directors’ terms will continue until the 20232026 annual meeting of stockholders:

Demetrios L. Kouzoukas. Demetrios L. Kouzoukas has served as a member of our Board of Directors since April 2021. Since April 2022, he has served as a Partner and Principal of Team8 Partners, a venture capital firm focused, in part, on cybersecurity, data and fintech, and he holds various positions with several affiliated Team8 entities. Prior to joining Clover Health's board,our Board, from February 2017 until January 2021, Mr. Kouzoukas served as the Director of the Center for Medicare and the Principal Deputy Administrator of the Centers for Medicare &and Medicaid Services ("CMS").Services. Previously, from 2012 to 2016, Mr. Kouzoukas served as General Counsel of the Medicare and Retirement Divisionbusiness of UnitedHealthcare, a health insurance company. Prior to UnitedHealthcare, from 2003 to 2009, Mr. Kouzoukas was Principal Associate Deputy Secretary of the U.S. Department of Health and Human Services ("HHS"), with responsibility for regulatory policy across HHS, and Deputy General Counsel. In 2014, Mr. Kouzoukas was appointed a Public Member of the Administrative Conference of the United States. Mr. Kouzoukas holds a B.A. in Political Sciencepolitical science and Public Policypublic policy from Thethe George Washington University and a J.D. from the University of Illinois College of Law. We believe that Mr. Kouzoukas is qualified to serve as a member of our Board of Directors because of his in-depth regulatory healthcare background, his experience as general counsel of a division of a health insurance company and his knowledge of our industry.

Andrew Toy. Andrew Toy has served as our PresidentChief Executive Officer since March 2019January 1, 2023, and as a member of our Board of Directors since November 2018. Prior to becoming Chief Executive Officer, he had served as our President since March 2019. He previously also served as our Chief Technology Officer from February 2018 to February 2022. Prior to joining Clover Health, from May 2014 to February 2018, Mr. Toy served as a Product Directorwas at Google LLC, a multinational technology company,company. He worked on the Google Cloud team where he coordinatedwas responsible for Developer Platform and Intelligence features, and led Android for Work, the enterprise activitiesplatform for Android. Mr. Toy joined Google as a result of the Android team and ran Machine Learning, Enterprise Search, and analytics for the G-Suite team. Before that, from January 2010 until May 2014 he was the CEO, director and co-founderacquisition of Divide, a company focused on creating a split between work and personal data on mobile devices whichFrom January 2010 through its acquisition, Mr. Toy was acquired by Google in 2014.the Chief Executive Officer, a director and co-founder of Divide. Mr. Toy holds a B.S. and an M.S. in computer science from Stanford University.University, where he has also served as an associate lecturer from June 2000 to April 2001. We believe that Mr. Toy is qualified to serve as a member of our Board of Directors due to the perspective and experience he brings as Clover Health's current Chief Executive Officer and former President and Chief Technology Officer, and due to his extensive experience overseeing technology and analytics and serving in leadership positions at other companies.

The following Class III directors' terms will continue until the 2024 annual meeting of stockholders:

Chelsea Clinton. Chelsea Clinton has served as a member of our Board of Directors since February 2017. Since March 2013, Ms. Clinton has served as Vice Chair of the Clinton Foundation, where her work emphasizes improving global and domestic health, creating service opportunities and empowering the next generation of leaders. Ms. Clinton has also served as an Adjunct Assistant Professor at Columbia University's Mailman School of Public Health since 2012. Ms. Clinton has served as a member of the board of directors of the Clinton Health Access Initiative since September 2011. Ms. Clinton has served as a member of the boards of directors of IAC Holdings, Inc., a media and internet company, since September 2011, and Expedia Group, Inc. (formerly Expedia, Inc.), an online travel shopping company, since March 2017. In addition to her for-profit affiliations, Ms. Clinton currently serves on the boards of directors of The School of American Ballet, The Africa Center, the Weill Cornell Medical College and Columbia University's Mailman School of Public Health, and as Co-Chair of the Advisory Board of the Of Many Institute at New York University. Ms. Clinton holds a B.A. in history from Stanford University, an MPhil and a DPhil in international relations from Oxford University and an M.P.H. from Columbia University's Mailman School of Public Health. We believe that Ms. Clinton is qualified to serve as a member of our Board of Directors because of her extensive health background, her experience as a director of public companies and non-profit organizations and her knowledge of our industry.

Carladenise Armbrister Edwards. Carladenise Armbrister Edwards has served as a member of our Board of Directors since July 2022. Since July 2020 Dr. Edwards has served as the Executive Vice President and Chief Strategy Officer of the Henry Ford Health System, where she leads the system's strategic planning efforts and partnership ventures, business development and transformation initiatives, government affairs strategy, as well as Henry Ford Innovations, the health system's multi-disciplinary team responsible for product design and commercialization, technology transfer, licensing agreements and international programs. Prior to Henry Ford, Dr. Edwards was Executive Vice President and Chief Strategy Officer for Providence St. Joseph

Health, a health system, from July 2018 to June 2020, and the Senior Vice President, Contracting for Providence St. Joseph Health from January 2017 to July 2018. Dr. Edwards' experience includes several additional executive leadership roles, including Chief Administrative Officer for Providence Health & Services' Population Health division and Chief Strategy Officer for Alameda Health System. Dr. Edwards also served as Founding President and CEO of Cal eConnect, Inc., a nonprofit corporation that governed California's electronic Health Information Exchange. Additionally, she has held technology-based leadership roles in Georgia's Department of Community Health. Dr. Edwards holds a Ph.D. in Medical Sociology from the University of Florida, a master's degree in Education and Psychological Services and a bachelor's degree in Sociology from the University of Pennsylvania. We believe that Dr. Edwards is qualified to serve as a member of our Board of Directors due to her expertise in the intersection of healthcare and technology, and her leadership experience in the healthcare industry.

Vivek Garipalli. Vivek Garipalli has served as our Chief Executive Officer and as a member of our Board of Directors since July 2014, and he also currently serves as our Chairperson. Mr. Garipalli also served as our President from July 2014 to March 2019. Prior to Clover Health, he founded CarePoint Health, a fully integrated healthcare system in New Jersey. In addition to Clover Health and CarePoint Health, he co-founded Ensemble Health, a healthcare services revenue cycle company, and advised Flatiron Health on the development of its strategy and business model. Mr. Garipalli sat on Flatiron Health’s board from 2012 until its sale to Roche in 2018, and has also served or is currently serving on the Boards of Cityblock Health, Doctor Evidence, Medically Home and Thyme Care. Before his career in healthcare, Mr. Garipalli worked in finance, holding roles at Credit Suisse First Boston, J.P. Morgan Partners and Blackstone Group. Wormhole Capital, the investment arm of his family office, now partners with founders seen as having the potential to anticipate what will move society and culture forward and the aptitude to build a transformative, category-defining company. Mr. Garipalli holds a B.B.A. in entrepreneurship from Emory University. We believe that Mr. Garipalli is qualified to serve as a member of our Board of Directors due to the perspective and experience he brings as Clover Health's co-founder and Chief Executive Officer and due to his extensive experience managing and advising healthcare companies.

Composition of Our Board of Directors

The primary responsibilities of our boardBoard of directorsDirectors are to provide oversight, strategic guidance, counseling and direction to our management. Our boardBoard of directorsDirectors meets on a regularquarterly basis and additionallymore frequently as required.necessary. Our boardBoard of directorsDirectors currently consists of seveneight directors.

Classified Board of Directors

Our amended and restated certificate of incorporation and our amended and restated bylaws divide our boardBoard of directorsDirectors into three classes, with staggered three-year terms:

•Class I directors, whose initial term will expire at the Annual Meeting;

•Class II directors, whose initial termterms will expire at the annual meeting of stockholders expected to be held in 2023; and2025;

•Class IIIII directors, whose initial termterms will expire at the annual meeting of stockholders expected to be held in 2024.2026; and

•Class III directors, whose terms expire at the Annual Meeting

At each annual meeting of stockholders, after the initial classification, the successors to directors whose terms have expired will be elected to serve from the time of election and qualification until the third annual meeting following election.

Board Leadership

The Board directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company.Company and its stockholders. The Board's responsibility is one of oversight, and in performing its oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with our stockholders.

The Board selects its chairperson ("Chairperson"(the "Chairperson") and the Company's Chief Executive Officer ("CEO") in the manner and based on the criteria that the Board deems appropriate. Therefore, the Board does not have a policy on whether the roles of Chairperson and Chief Executive OfficerCEO should be separate or combined and, if it isthe roles are to be separate, whether the Chairperson should be selected from the independent directors. At

Beginning in January 2023, the present time,role of Chairperson and CEO have been separated, with Mr. Garipalli servesserving as the Executive Chairperson and Mr. Toy serving as CEO. As Executive Chairperson, Mr. Garipalli provides leadership to the Board and plays an important role in guiding the Board in its exercise of the Board.oversight of key Company business activities and risks. Because Mr. Garipalli is also the Company's Chief

Executive Officer,not an independent director, the Board's independent directors have appointed Demetrios L. Kouzoukas to serve as the lead independent director.

The Board believes that the current leadership structure is appropriate givenand in the best interests of the stockholders. The leadership structure, with Mr. Garipalli's role in co-foundingGaripalli serving as Executive Chairperson, Mr. Toy serving as CEO and leading the Company. In addition, the Board believes that the leadership structureMr. Kouzoukas serving as lead independent director, enables the Board to focus on key policystockholder governance and operational issues and helps the Company operate in the best interests of its stockholders.

On August 8, 2022, the Company announced a plan of succession whereby, effective as of January 1, 2023, Mr. Garipalli will become the Executive Chairman of the Board and leave his position as Chief Executive Officer, and Andrew Toy, the Company’s current President, will be promotedstrategic matters while providing oversight to the position of Co-Founder and Chief Executive Officer and will no longer serve in his role as President. The plan of succession was approved by the BoardCEO on August 5, 2022.operational matters.

Executive Sessions

The non-management directors meet in executive session with no members of management present periodically at each regularly scheduled meetings of the Board and, ifBoard. If the non-management directors include directors who have not been determined to be independent, the independent directors separately meet in a private session at least once per yearsessions that excludesexclude management and directors who have not been determined to be independent.independent, at each quarterly meeting. The lead independent director presides at the executive sessions of the Board.

Communications with Directors

Stockholders and other interested parties may communicate with the Board by writing to the Board, c/o General Counsel, Clover Health Investments, Corp., 3401 Mallory Lane, Suite 210, Franklin, TN 37067. Written communications may be addressed to the Chairperson of the Board, to the lead independent director, or to the independent directors as a group. Such communications will be forwarded to the appropriate party.

Risk Oversight

The Board exercises direct oversight of strategic risks to the Company. The Board administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. Our Audit Committee reviews guidelines and policies governing the process by which senior management assesses and manages the Company's exposure to risk, including the Company's major financial and operational risk exposures and the steps management takes to monitor and control suchthose exposures. The Company's Chief Financial Officer updates the Board and the Audit Committee regularly throughout the year, and moreas frequently as necessary and appropriate. The Board and Audit Committee provide feedback and recommendations accordingly. TheOur Talent and Compensation Committee oversees risks relating to the Company's compensation policies and practices.practices, and conducts a compensation risk assessment. Each committee charged with risk oversight reports to the Board on those matters.

The Board has assigned oversight of cybersecurity risk management to its Audit Committee. The Audit Committee reviews the adequacy and effectiveness of the Company’s cybersecurity policies and internal controls regarding information and cybersecurity, and together with the full Board, regularly receives reports from our and our subsidiaries’ management, including our Chief Information Security Officer on cybersecurity matters, including, but not limited to: Security Awareness, Internal Risk, Third-Party Risk, IR / DR Readiness, Access Control IAM/PAM, HIPAA Security Rule Compliance, Phishing, Security Monitoring, Vulnerability Management, Application Security, Governance, Data Security, and Cloud Security.

Corporate Responsibility

Code of Business Conduct and Ethics

Our Board of Directors has adopted a code of business conduct and ethics that applies to all of our executive officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The code of business conduct and ethics isand amendments to the code of business conduct and ethics are available on our website, www.investors.cloverhealth.com. In addition, we https://investors.cloverhealth.com by clicking on "Governance Overview" in the "Governance" section of our website. We intend to make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of business conduct and ethics on our website rather than by filing a Current Report on Form 8-K.

Advancing Health Equity

We believe the success of our business is connected to our impact on and relationships with our employees, customers, clinicians, vendors, and the communities we serve. We strive to have a business model that offers equitable access to healthcare for Medicare beneficiaries. Boosting health equity is about everyone being able to achieve their full health potential, regardless of socio-economic and demographic factors including race, gender, age orand income. Since Clover's founding in 2014, our team members have shared a single vision: Do whatever we canvision to improve the quality of life for all Medicare beneficiaries, their families, and the doctors who care for them.

every life. We have made it a priority to work with Medicare beneficiaries in underserved communities. Clover has been identified as a plan with strong performance on a prototype of the Insurance Health Equity Summary Score, which is a newly developed measurement tool for identifying plans that do well at providing high-quality, equitable care to their members, including groups who are disproportionately affected by social risk factors. We believe this achievement is evidence of Clover's success in ensuring high-quality care for those most in need.

Cultivating Diversity, Equity & Inclusion

We have made a deliberate commitmenteffort to cultivatingcultivate a diverse and inclusive culture at Clover. Early on in our history, Clover created a Diversity & Inclusion ("D&I") Working Group ("D&I Working Group") focused on making Clover a more diverse, equitable, and inclusive company.Company. For us, diversity includes not only race and gender identity, but also age, disability status, veteran status, sexual orientation, religion, and many other parts of one's identity. All of our employees' points of view are key to our success, and inclusion is everyone's responsibility. By creating a designated space for learning, conversations, and furthering initiatives, we aim to enrich Clover for our employees and communities. Members of our D&I Working Group also develop and deliver various resources to our teams, including an ally-ship training series and "best practices" materials on topics such as inclusive meetings and health equity.

Affinity Groups are employee-led groups, open to Clover employees who identify with an affinity and are looking for community and support within the Company. Clover's Affinity Groups continue to grow as grassroots communities bringing together employees with a shared affinity. We currently have fourfive Affinity Groups with a total of over 130150 members and growing: Black Employee Network; Asian, Asian American, and Pacific Islanders;Islander; Mi Gente (Latine/Hispanic); and Queer at Clover.Clover; and Clover Wome/xn (all employees identifying as women). Additionally, our mental health benefits include options to join expert-led external peer circles around healing communities in times of crisis.

We are in the thirdfifth year of our New Perspectives Program, a reverse mentorship program that creates a space for leaders to receive mentorship from junior-junior and mid-level employees about lived experiences and key information leaders need to understand in their role. These conversations have focused on a range of themes, such as the experiences of LGBTQ+ employees, Latina employees, and understanding biases that lead to who gets elevated and who gets left behind in the workplace.

As of June 30, 2022, 64%At December 31, 2023, 63% of our employees were women,workforce was Female and 55%53% of our employees in the United States wereworkforce was from underrepresented groups (which includes Black/African American, Hispanic or Latinx, Pacific Islander and American Indian/Alaskan).racially/ethnically diverse backgrounds.

Committees of the Board

Audit Committee

Our Audit Committee consists of Lee A. Shapiro,Demetrios L. Kouzoukas, William G. Robinson, Jr., and Demetrios L. Kouzoukas,Lee A. Shapiro, with Mr. Shapiro serving as the chairChair of the committee.Audit Committee. The Audit Committee met five times during 2023. The composition of our Audit Committee meets the requirements for independence under the current NASDAQNasdaq listing rulesstandards and SEC rules and regulations. Each member of our Audit Committee is financially literate. In addition, our Board of Directors has determined that Mr. Shapiro is an Audit Committee financial expert within the meaning of Item 407(d) of Regulation S-K of the Securities Act of 1933, as amended (the "Securities Act") and meets the financial sophistication requirements of the NASDAQNasdaq listing rules.standards. Our Audit Committee is responsible for, among other things:

•selecting a firm to serve asAppointing, compensating, retaining, overseeing the Company's independent registered public accounting firm to audit our financial statements;

•helping to ensurework of and terminating the independenceengagement of the independent registered public accounting firm;auditors;

•discussingReviewing on a continuing basis the scope and resultsadequacy of the Company's system of internal controls;

•Pre-approving all audit withand permissible non-audit services and related engagement fees and terms for services provided to the Company by the independent registered public accounting firm,auditors;

•Reviewing and reviewing,providing guidance with respect to the external audit and the Company's relationship with its independent auditors;

•Reviewing and discussing with management and the independent accountants, our interimauditors the Company’s annual audited financial statements and year-end operating results;quarterly unaudited financial statements;

•Reviewing any reports by management or internal auditors, if any, regarding the effectiveness of, or any deficiencies in, the design or operation of internal controls and any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal controls;

•Periodically reviewing the Company’s code of business conduct and ethics;

•Conducting appropriate review and oversight of related party transactions, as defined by applicable rules of the SEC and Nasdaq Stock Market;

•Establishing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters;

•Reviewing and discussing with management, the independent auditor and the internal auditor, if any, to identify, monitor, and address enterprise risks; and

•Reviewing the adequacy and effectiveness of the Company’s information and cyber security policies and the internal controls regarding information and cyber security.

•developing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; and

•considering the adequacy of our internal accounting controls and audit procedures.

Our Audit Committee has a written charter approved by our Board of Directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.cloverhealth.com, by clicking on "Governance Overview" in the "Governance" section of our website.

Talent and Compensation Committee

Our Talent and Compensation Committee consists of Chelsea Clinton, Carladenise Armbrister Edwards, Anna U. Loengard, and William G. Robinson, Jr. and Carladenise Armbrister Edwards,, with Mr. Robinson serving as the chairChair of the committee.Talent and Compensation Committee. The Talent and Compensation Committee met seven times in 2023. The Talent and Compensation Committee's responsibilities include, among other things, the following;

•setting the compensation of our CEO and, in consultation with the CEO, reviewing and approving the compensation of our other executive officers;

•establishing annual and long-term performance goals and objectives for the CEO and, in consultation with the CEO, reviewing and establishing the goals and objectives for our other executive officers;

•evaluating the performance of the CEO and, in consultation with the CEO, reviewing and evaluating the performance of our other executive officers;

•approving employment agreements, offers of employment, severance or termination arrangements or plans and other elements of compensation and benefits (other than ordinary benefits provided broadly to employees) provided to the CEO and our other executive officers:

•providing oversight of the Company's overall compensation and incentive plans and benefits programs;

•reviewing on a periodic basis, and making recommendations to the Board as to, the compensation payable by the Company to non-employee directors;

•reviewing and discussing with management the Company's "Compensation Discussion and Analysis" ("CD&A") to be included in the Company's annual report or proxy statement and recommending to the Board that the CD&A be included in the annual report or proxy statement;

•reviewing with management the Company’s major compensation-related risk exposures and the steps management has taken to monitor and control such exposures, and assessing whether the Company’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company;

•assessing the results of the Company's most recent Say-on-Pay Vote and taking such assessments into consideration when establishing the compensation of the Company's executive officers; and

•periodically reviewing and discussing with the CEO and the Board the development and succession plans for senior management positions

Our Talent and Compensation Committee has a written charter approved by our Board of Directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.cloverhealth.com, by clicking on "Governance Overview" in the "Governance" section of our website. For additional detail on the Talent and Compensation Committee, see the section entitled "Executive"Executive and Director Compensation"Compensation" below.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Chelsea Clinton, Carladenise Armbrister Edwards and Lee A. Shapiro, and Carladenise Armbrister Edwards, with Mr. Shapiro serving as chair of the committee. The Nominating and Corporate Governance Committee met four times in 2023. The composition of our nominatingNominating and governance committeeCorporate Governance Committee meets the requirements for independence under the current NASDAQNasdaq listing standards and SEC rules and regulations. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying, reviewing and making recommendations to the Board concerning the composition and organization of the Board and its committees;

•determining the desired qualifications, expertise and characteristics for potential directors and assessing the independence of any candidates identified for consideration;

•evaluating and recommending nominees for election to ourthe Board;

•developing and recommending to the Board a set of Directorscorporate governance guidelines applicable to the Company and its committees;reviewing those guidelines from time to time;

•conducting searchesdeveloping and overseeing an annual process for appropriate directors;

•evaluatingevaluation of the performance of ourthe Board of Directors and each of individual directors;

•considering and making recommendations to our Board of Directors regarding the composition of the board and its committees;

•periodically reviewing developmentsand discussing the development and succession plan for the CEO; and

•reviewing annually the Executive Chairperson’s performance against the responsibilities outlined in our corporate governance practices;the Executive Chair Duties and Responsibilities policy and as otherwise established by the Board

•evaluating the adequacy of our corporate governance practices and reporting; and

•making recommendations to our Board of Directors concerning corporate governance matters.

Our Nominating and Corporate Governance Committee has a written charter approved by our Board of Directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.cloverhealth.com, by clicking on "Governance Overview" in the "Governance" section of our website.

Clinical Committee

Our Clinical Committee consists of Carladenise Armbrister Edwards, Demetrios Kouzoukas and Anna U. Loengard, with Dr. Loengard serving as chair of the committee. The Clinical Committee met four times in 2023. Each member of the Clinical Committee is an independent director under Nasdaq listing standards and SEC rules and regulations. Our Clinical Committee is responsible for, among other things:

•reviewing significant clinical strategies and initiatives of the Company, and matters concerning efforts to (1) advance the quality of clinical and medical care and member experience, (2) enhance access to cost-effective quality health care, (3) promote member health, and (4) enhance clinician experience and decision making;

•reviewing and recommending to the Board policies, positions and practices concerning broad public policy issues, including those that relate to health care policy and regulatory issues, including health care reform and modernization;

•overseeing the Company’s clinical practices and policies, including quality, utilization management, key clinical trends and priorities and to provide a forum for the Company’s clinicians to discuss such practices, priorities and trends with the Board;

•overseeing management’s efforts and initiatives to expand access to health care, improve health care affordability and clinical care, enhance the health care experience, achieve better health outcomes, advance health equity, and reduce health disparities;

•assisting in developing strategies and overseeing the Company’s progress related to the Centers for Medicare and Medicaid Services Star Ratings; and

•overseeing the Company’s external communications related to the clinical efficacy of its care programs and Clover Assistant tool

Our Clinical Committee has a written charter approved by our Board of Directors. A copy of the charter is available on the Investor Relations section of our website, which is located at https://investors.cloverhealth.com, by clicking on "Governance Overview" in the "Governance" section of our website.

Nomination to the Board of Directors

Candidates for nomination to our Board of Directors are selected by our Board of Directors based on the recommendation of our Nominating and Corporate Governance Committee in accordance with its charter, our amended and restated certificate of incorporation and amended and restated bylaws, our Corporate Governance Guidelines and the criteria approved by our Board of Directors regarding director candidate qualifications. In recommending candidates for nomination, our Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Among the criteria the Nominating and Corporate Governance Committee and the Board of Directors may consider are experience, including executive leadership experience, and diversity; and withdiversity. With respect to diversity, the Board may consider, among others,other individual qualities and attributes: diverse demographic factors, differences in professional background, experience at policy-making levels in business, finance, healthcare, law, technology, and other areas, education skill, and other individual qualitiesskills. The Nominating and attributes. TheCorporate Governance Committee and the Board endorse the value of seeking qualified directors from backgrounds otherwise relevant to the Company's mission, strategy and business operations and perceived needs of the Board at a given time.

Our amended and restated bylaws provide that stockholders may present nominations to be considered at an annual meeting by providing timely notice to our Corporate Secretary at our principal executive office.offices. A stockholder's notice to the Corporate Secretary must set forth the information required by our amended and restated bylaws. If a stockholder who has notifiednotifies Clover Health of such stockholder'stheir intention to present a nomination of persons for election at an annual meeting, and does not appear at the annual meeting to present such stockholder'stheir proposal, at such meeting, Clover Health does not need to present the nomination of persons for election for vote at suchthe annual meeting.

Commitment to Board Diversity

The Company believes it is important that nominees for the Board represent diverse viewpoints and backgrounds. The Company is committed to advancing Board diversity, defined to includeincluding differences of viewpoint, professional experience, education, skill, race, gender and national origin. The Company believes that its nominees furtherand incumbent Board members reflect its commitment to enhancing diversity at the Board level. The following table illustrates the gender and demographic diversity of our current Board:

| | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of August 2, 2022) |

| Total Number of Directors | 7 |

| Female | Male | Non-

Binary | Did Not Disclose Gender |

| Part I: Gender Identity | |

| Directors | 2 | 4 | - | 1 |

| Part II: Demographic Background | | |

| African American or Black | 1 | 1 | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | 2 | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 1 | 1 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | 1 |

| | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 26, 2024) |

| Total Number of Directors | 8 |

| Female | Male | Non-

Binary | Did Not Disclose Gender |

| Part I: Gender Identity | |

| Directors | 3 | 4 | - | 1 |

| Part II: Demographic Background | | |

| African American or Black | 1 | 1 | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | 2 | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 2 | 1 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | 1 |

Board Meetings

The Board meets regularly during the year, and it holds special meetings and acts by unanimous written consent whenever circumstances require. During 2021,2023, there were 12six meetings of the Board. Each of our existingincumbent directors attended at least 75% of the aggregate of the total number of meetings of the Board (held during the period for which he or she wasthey were a director) and the total number of meetings held by all committees on which he or shethey served (during the periods that he or shethey served) during 2021.2023. While there is no formal policy regarding Board attendance at the Company's annual meetings of stockholders, all directors are invited and encouraged to attend the Company's annual meetings. The 2023 annual meeting of stockholders was attended by seven of the eight directors serving on the Board at the time of the 2023 annual meeting.

Director Independence

In evaluating the independence of the members of our board membersBoard of Directors and the composition of the committees of our board,Board of Directors, we utilize the definition of "independence" as that term is defined by the NASDAQ Listing Rules.Nasdaq listing standards. The NASDAQNasdaq listing rulesstandards generally require that a majority of the members of a listed company's Boardboard of Directorsdirectors be independent within specified periods following the completion of an initial public offering. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company's audit, compensation and governance committees be independent.

Audit Committeecommittee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended or Exchange Act.(the "Exchange Act"). In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or hertheir capacity as a member of the audit committee, the boardBoard of directors,Directors, or any other board committee of the Board, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries, or be an affiliated person of the listed company or any of its subsidiaries. Compensation committee members must also satisfy the independence criteria as required by Rule 10C-1 under the Exchange Act.

Our Board of Directors has determined that none of the members of our Board of Directors other than Messrs.Mr. Toy and Mr. Garipalli and Toy hashave a relationship that would interfere with the exercise of independent judgment in carrying out thetheir responsibilities ofas a director anddirector. It has also determined that each of the members of our Board of Directors other than Messrs.Mr. Toy and Mr. Garipalli, and Toy, and each of the members of the Audit Committee, Talent and Compensation Committee, and Nominating and Corporate Governance Committee and Clinical Committee, is "independent" as that term is defined under the NASDAQ rules.Nasdaq listing standards.

Executive Officers

On August 8, 2022, the Company announced a plan of succession whereby, effective as of January 1, 2023, Mr. Garipalli will become the Executive Chairman of the Board and leave his position as Chief Executive Officer, and Andrew Toy, the Company’s current President, will be promoted to the position of Co-Founder and Chief Executive Officer and will no longer serve in his role as President. The plan of succession was approved by the Board on August 5, 2022.

The followingbelow table provides information regarding our executive officers as of August 2, 2022:April 26, 2024.

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Executive Officers |

Andrew Toy(1) | | 45 | | Co-Founder, Chief Executive Officer and Director |

Terrence Ronan(2) | | 64 | | Interim Chief Financial Officer |

| Karen Soares | | 46 | | General Counsel and Corporate Secretary |

| Brady Priest | | 48 | | Chief Executive Office of Home Care |

| Jamie L. Reynoso | | 55 | | Chief Executive Officer of Medicare Advantage |

| Aric Sharp | | 50 | | Chief Executive Officer of Value-Based Care |

| Conrad Wai | | 43 | | Chief Technology Officer |

(1) Biographical information pertaining to Mr. Garipalli and Mr. Toy can be found above in the section entitled "–"– Board of Directors."

| | | | | | | | | | | | | | | | | |

Name | | Age | | Position(s) |

Executive Officers |

Vivek Garipalli | | 44 | | Chief Executive Officer and Chairman |

Andrew Toy | | 43 | | President and Director |

Scott J. Leffler | | 47 | | Chief Financial Officer |